Now Offer Your Investors Two Ways to Invest.

Give your backers the flexibility to invest directly or donate-to-invest,

all fueling your mission.

✅ Tap into $2.2T in untapped philanthropic capital

✅ Attract early, aligned investors who care about your mission

✅ Learn how patient, flexible capital works

✅ Get practical tips for raising $50K–$2M from DAFs and foundations

📅 June 11th, 2025

⏰ 11:00 AM Pacific Time

CataCap revolutionizes fundraising for impact-oriented ventures by providing access to a diverse pool of mission-aligned capital. Our platform connects visionary entrepreneurs with donor-investors eager to support transformative ideas that align with their values. Unlike traditional funding avenues, CataCap offers:

Whether you’re launching a social enterprise or scaling an established impact-driven business, CataCap provides the tools and community to help you succeed. By leveraging donor-advised funds and philanthropic capital, we unlock resources previously sitting idle, channeling them into ventures that create real change. Join us to make raising capital for impact easier, faster, and more collaborative than ever before.

CataCap unlocks a new way to fund your mission by turning donations into investment capital. We provide the nonprofit platform, tools, and guidance — you bring the community.

Whether it’s a few major backers or many small supporters, having early donor-investors lined up is key to launching strong. We’ll help you prepare with resources on outreach, campaign design, and platform strategy.

Our long-term vision is a thriving ecosystem of donor-investors actively discovering and supporting organizations like yours. As we build toward that future, early campaigns succeed by bringing their network with them.

We’re here to help you get there — and grow with you from day one.

To help you launch strong, all new campaigns on CataCap must raise at least $25,000 within the first 45 days. This early traction is crucial for showing momentum and attracting more investors.

We recommend waiting to submit your raise money form below until you’ve spoken with a few lead donors who are ready to donate through CataCap to invest when your campaign launches. Their early commitment can significantly boost your visibility and success.

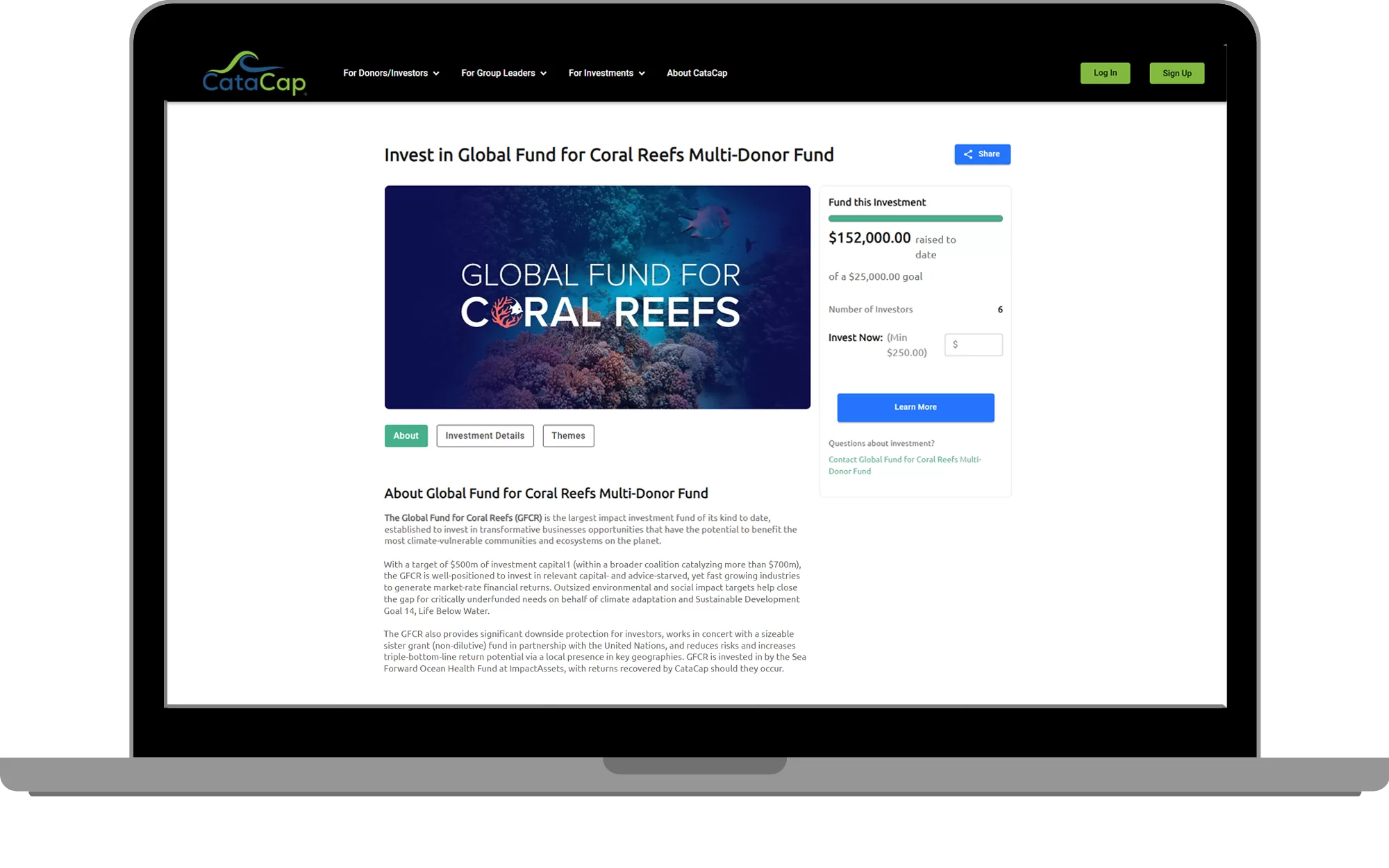

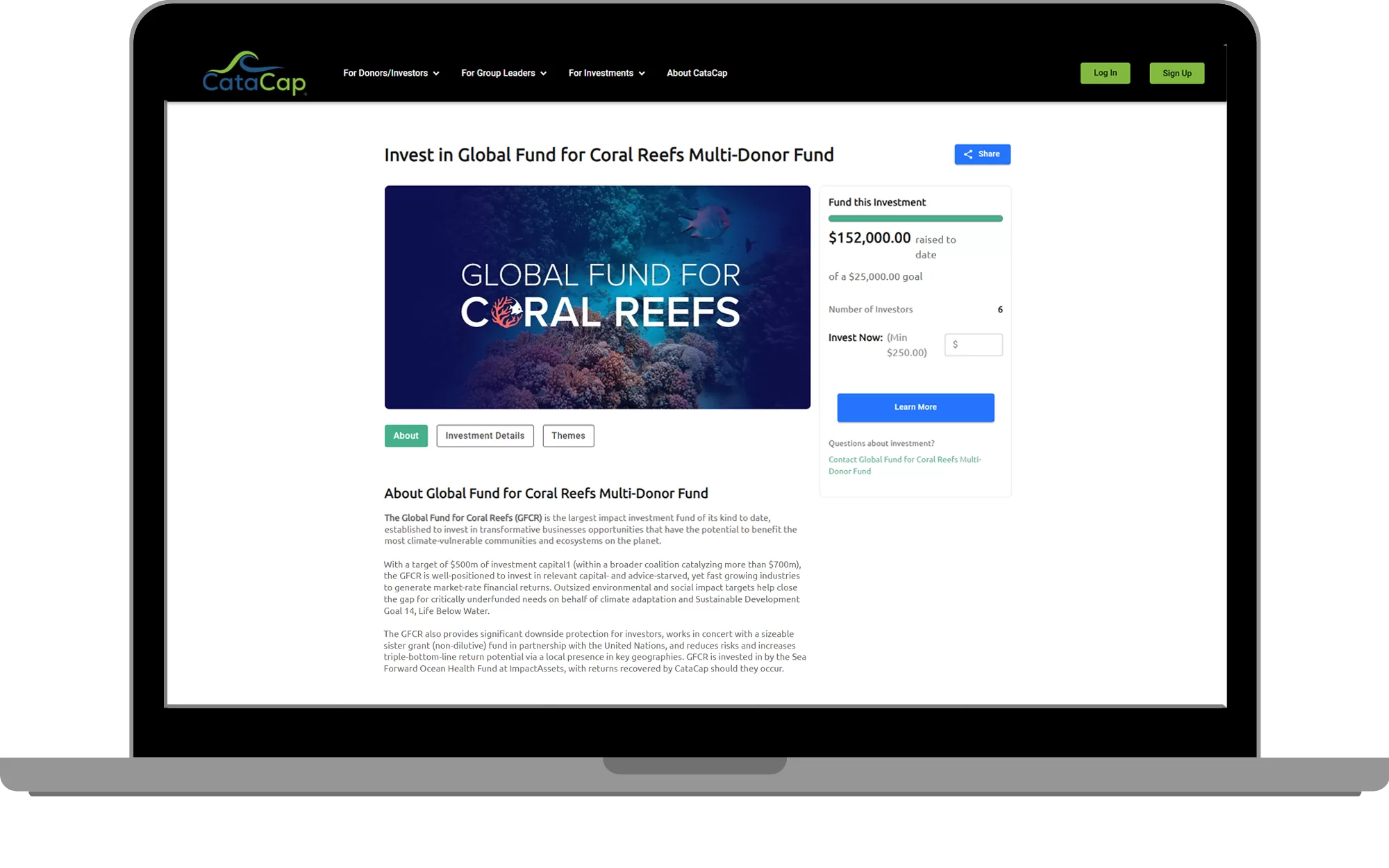

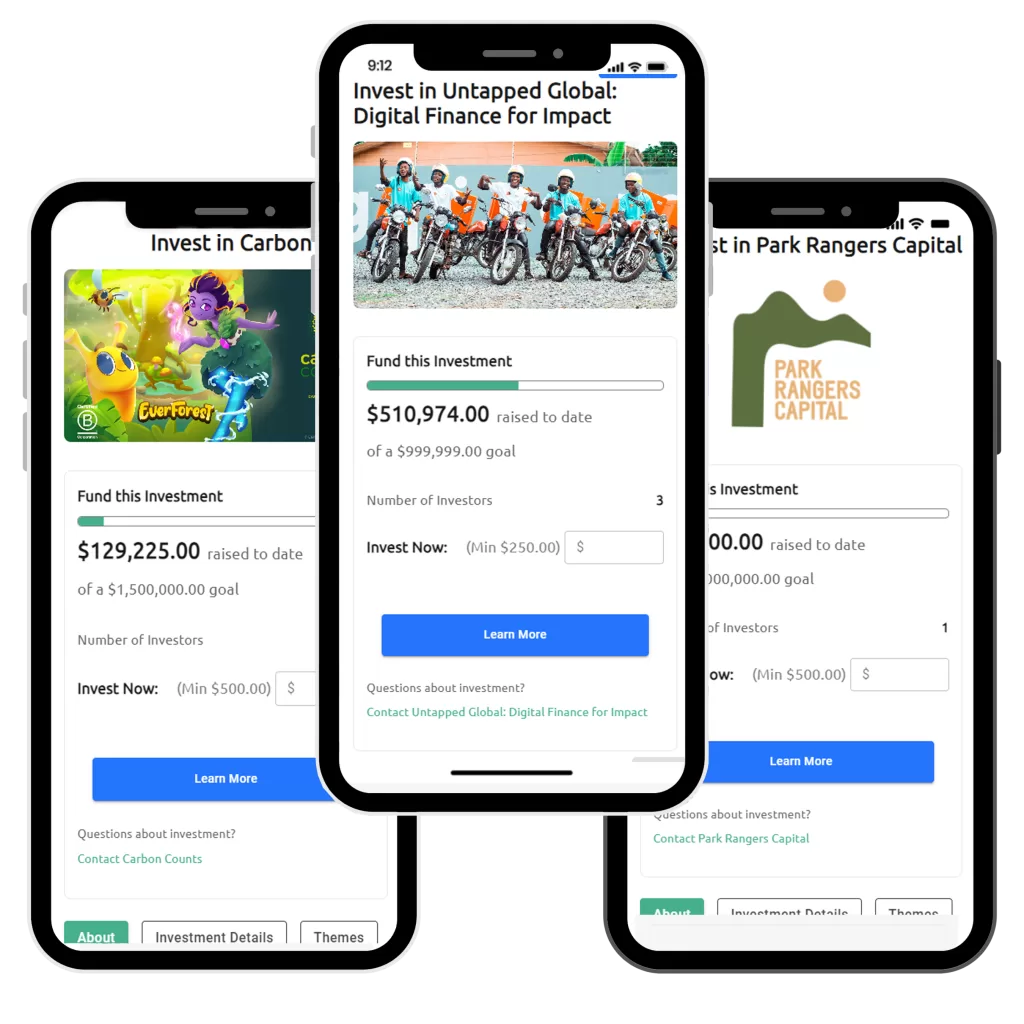

Complete the form and we’ll reach out to learn more and see how we can support your cause. If approved, this information will be used to create your investment page similar to this example.

An Investment on CataCap is any fund or company willing to accept an impact investment sourced from donors. It can have any focus, yet frequently targets some combination of the overarching themes of climate solutions, racial equity, gender equality and/or poverty alleviation.

Donated capital is contributed to a nonprofit, foundation or donor advised fund (DAF) for philanthropic purposes. These funds can then be used for impact investments. Unlike regular angel, VC, or friends and family investors, primarily motivated by financial returns, donated capital may operate from different motivations:

Donated capital works well for investments that create a clear environmental or social impact, where financial returns are expected, yet with the focus of generating positive change. Examples of impact investments that align with donated capital include:

The investment terms of CataCap Investments are generally aligned with the terms of any ongoing investment structure, consistent with other investors participating. Key factors include:

CataCap simplifies the process of managing multiple small investments by accumulating all donations into a single investment. Rather than having numerous individual investors on your cap table, CataCap consolidates the funds and makes a single investment into your company or fund as an accredited, institutional investor. This means that only one name—representing all the investment recommendations—will appear on the cap table or as a loan.

This structure provides several benefits:

CataCap is particularly effective in gathering funding from the following types of investors:

Investors who previously said no:

Current Investors Looking to Increase Participation Without Using Personal Funds:

Category-Focused Donors:

Investors Who Want to “Dip Their Toe In” or Invest Smaller Amounts:

It’s a charitable donation that is then invested for impact and financial returns.

You should use the exact same guidelines, principles, and legal constraints as your normal outreach. In simple terms, you don’t want to make solicitations to non-accredited investors. CataCap can provide some sample language appropriate for outreach to accredited, and separately to non-accredited individuals.

CataCap aggregates lots of smaller donations and grants into one large pool of assets, providing a cost structure to donors of as little as $250. to that of a million dollar DAF. CataCap passes these savings on to its community, providing access to capabilities typically reserved for large charitable vehicles making larger investments.

Here is the fee structure for donations and grants, charged as funds inflow to CataCap:

Please note that tax-deductible receipts are issued for credit card and ACH/bank transfers at the original donation amount, before any fees are deducted.

There are no fees for investees on CataCap. We do not charge any fees for the investments made through our platform. The only fees are incurred by donors or investors when they add funds to their CataCap accounts to make an investment. This ensures that investees receive funding without additional costs.

For your reference, here is the fee structure for donors/investors:

Investors are issued tax-deductible receipts for the original donation amount, before any fees are deducted.

A Donor Advised Fund (DAF) is a charitable giving vehicle that allows donors to make a charitable contribution, receive an immediate tax deduction, and recommend grants from the fund over time to qualified nonprofit organizations. Managed by public charities or financial institutions, a DAF provides flexibility by allowing donors to grow the donated capital tax-free and distribute it to charities at their discretion. While the funds are irrevocably committed to charitable use, donors maintain advisory privileges, directing how and when their contributions are granted to their causes of choice.

Raising capital from foundations, Donor Advised Funds (DAFs), or donations offers unique advantages for companies seeking impact-driven investments. Here’s why:

This combination of untapped resources, patient and flexible capital, higher risk tolerance, and mission-aligned investment provides a compelling case for companies to consider raising capital from foundations, DAFs, or donations.

Donated capital refers to funds contributed to a foundation or Donor Advised Fund (DAF) for philanthropic purposes, and these funds can then be used for impact investments. Unlike regular angel, VC, or friends and family investors who are primarily motivated by financial returns, donated capital operates under different incentives:

In contrast, angel, VC, or friends and family investors are usually looking for financial gains and returns on their investments within a specific timeframe. They tend to have lower risk tolerance, expect quicker exits, and are motivated by personal financial gain rather than purely philanthropic objectives.

In summary, donated capital provides a flexible, mission-driven alternative to traditional investment, often with greater tolerance for risk, a longer-term perspective, and less pressure on financial returns.

Donated capital from a foundation or Donor Advised Fund (DAF) or direct charitable gift works well for investments that create a clear environmental or social impact. These are not donations—these are investments where financial returns are expected, but the focus is on generating positive change. Examples of ventures that align with donated capital include:

The return on investment is important because it allows the foundation or DAF to reinvest those funds into new impact-driven ventures or use the proceeds to make charitable grants to nonprofits of their choice. The expectation is not just financial return but a measurable social or environmental benefit, creating a sustainable cycle of impact. Investors using donated capital are typically more flexible and patient than traditional investors, making them an ideal partner for long-term, purpose-driven ventures.

The investment terms for donor/investors using donated capital are generally aligned with the terms of any ongoing fundraising efforts your company is conducting. This ensures consistency with other investors. If you are not currently fundraising, you have the flexibility to set the investment terms, ensuring they are attractive and relevant to donor/investors, who are often impact-focused.

Key factors to consider include:

Type of Investment: Donor/investors can invest through various structures such as private equity, private debt, venture capital, loans, project finance, real assets, and more, depending on what suits your business model.

Term Length: Typically, donor/investors have a longer-term horizon, as they are more focused on sustainable impact rather than quick exits.

Expected Return: While a financial return is expected, donor/investors tend to be more flexible compared to traditional investors. The primary focus is on social or environmental impact, but returns allow them to reinvest in other impact investments or make charitable grants to nonprofits.

Impact Metrics: Donor/investors will be most interested in ventures that have clear, measurable social or environmental outcomes. Impact metrics should be defined as part of the terms.

By setting terms that reflect both the financial and impact goals of the donor/investors, you can ensure a productive and aligned partnership that supports long-term growth and positive change.

CataCap simplifies the process of managing multiple investments by accumulating all contributions from Foundations, Donor Advised Funds (DAFs), and direct charitable donations into a single pool. Rather than having numerous individual investors on your cap table, CataCap consolidates these funds and makes a single investment into your company. This means that only one name—representing the entire investment pool—will appear on the cap table.

This structure provides several benefits:

In essence, CataCap allows you to receive large, aggregated capital from multiple sources while keeping your cap table clean and manageable with only one entry.

CataCap is particularly effective in helping fundraise from the following audiences:

Investors Who Have Said No:

Risk-Averse Investors:

Current Investors Looking to Increase Contributions Without Using Personal Funds:

Category-Focused Donors:

Investors Who Want to “Dip Their Toe In” or Invest Smaller Amounts:

CataCap is particularly suited for donors and investors who want to see their contributions go further by combining philanthropic capital with social or environmental impact investments, offering flexibility and accessibility to a wide range of supporters.