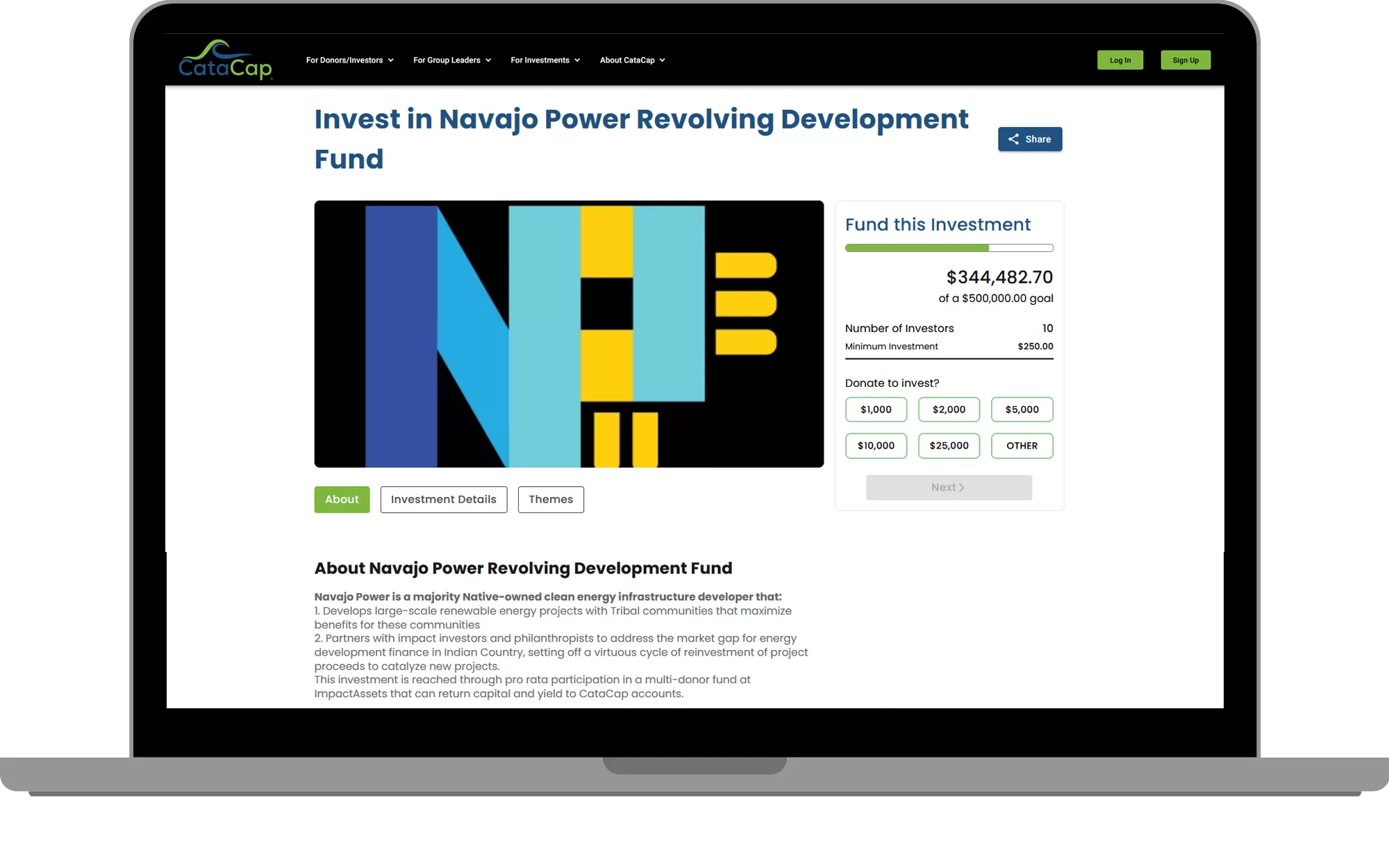

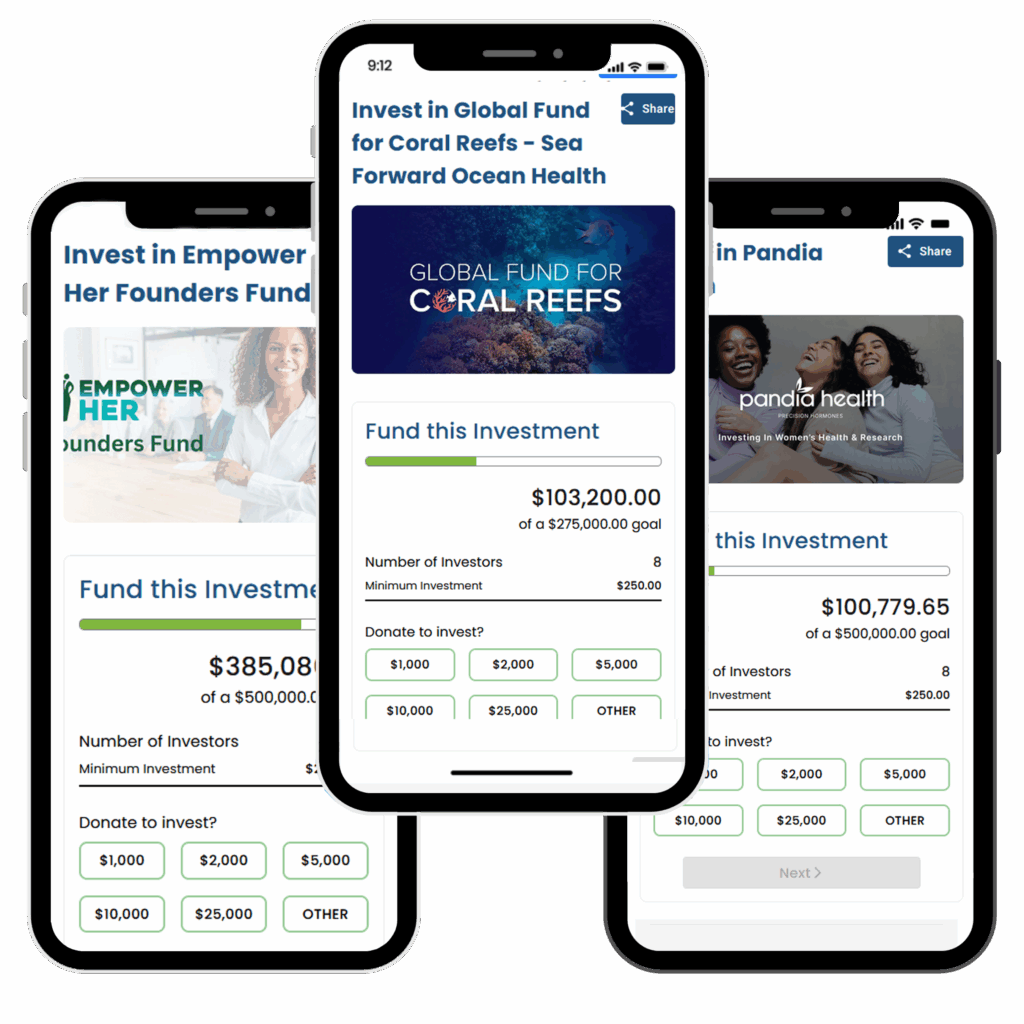

Now Offer Your Investors Two Ways to Invest.

Give your backers the flexibility to invest directly or donate-to-invest,

all fueling your mission.

Give your backers the flexibility to invest directly or donate-to-invest,

all fueling your mission.

Introduction to Raising Capital on CataCap

We explore how mission-driven ventures can raise $50k – $2M from DAFs, foundations, friends, and family to leverage patient, flexible, and mission-aligned capital to scale impact through CataCap. This video is intended for impact-driven ventures and fundraisers looking to:

CataCap helps impact-oriented ventures raise capital by providing the structure, tools, and education to engage mission-aligned supporters in a charitable investment model. Our platform enables founders and fund managers to invite their network to support their work through patient, flexible capital — including donations made via donor-advised funds (DAFs).

Unlike traditional funding avenues, CataCap offers:

Whether you’re launching a new venture or scaling an established impact-driven organization, CataCap provides the platform and guidance to help you mobilize philanthropic capital that might otherwise remain unused in the for-profit, impact space.

Founders lead the outreach; CataCap supplies the structure to make charitable investing possible, compliant, and repeatable.

CataCap unlocks a new way to fund your mission by turning donations into investment capital. We provide the nonprofit platform, tools, and guidance — you bring the community.

Whether it’s a few major backers or many small supporters, having early donor-investors lined up is key to launching strong. We’ll help you prepare with resources on outreach, campaign design, and platform strategy.

Our long-term vision is a thriving ecosystem of donor-investors actively discovering and supporting organizations like yours. As we build toward that future, early campaigns succeed by bringing their network with them.

We’re here to help you get there — and grow with you from day one.

2026, CataCap. All Rights Reserved